The FTSE 100 is packed with brilliant value shares right now. If I had cash to invest, here are three I’d buy before the market wises up to their cheapness.

Standard Chartered

Asia-focused banks like Standard Chartered (LSE:STAN) face near-term uncertainty as China’s economy toils. Yet on balance I believe the company (like industry rival HSBC) has supreme investment potential thanks to favourable demographic trends.

A combination of steady population growth and booming personal wealth means demand for its wealth management, and retail and investment banking services, is soaring. These helped constant currency revenues surge 20% in the first three months of 2024.

Should you invest £1,000 in Legal & General right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Legal & General made the list?

Today Standard Chartered shares trade on a rock-bottom price-to-earnings (P/E) ratio of 6.3 times. This makes it one of the cheapest banks on the Footsie today.

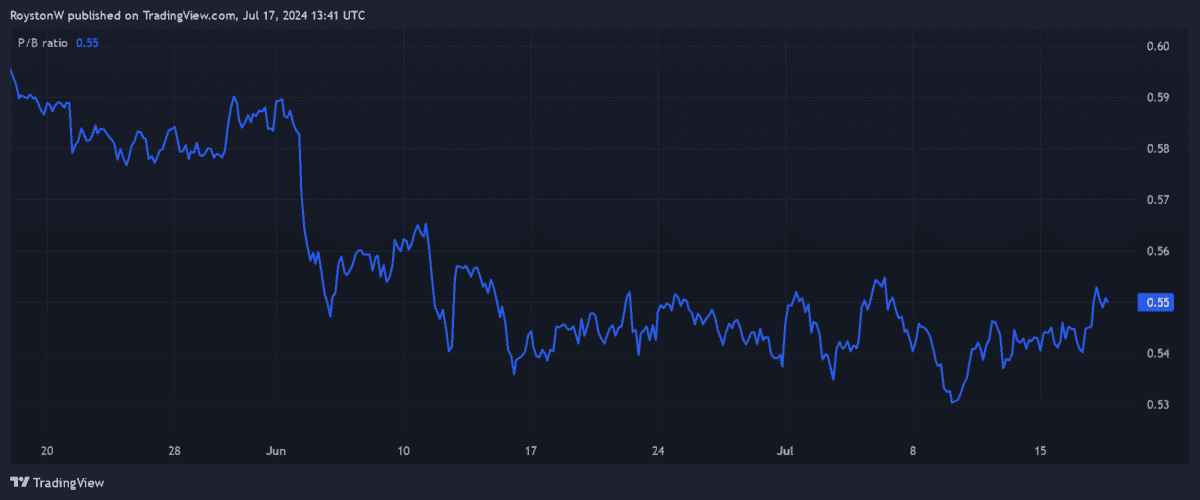

But this isn’t the only metric that suggests it could be a top value stock today.

At 732.6p per share, the bank also boasts an incredibly low price-to-book (P/B) ratio of around 0.6. At below one, this indicates that it trades at a discount to the value of its assets.

WPP

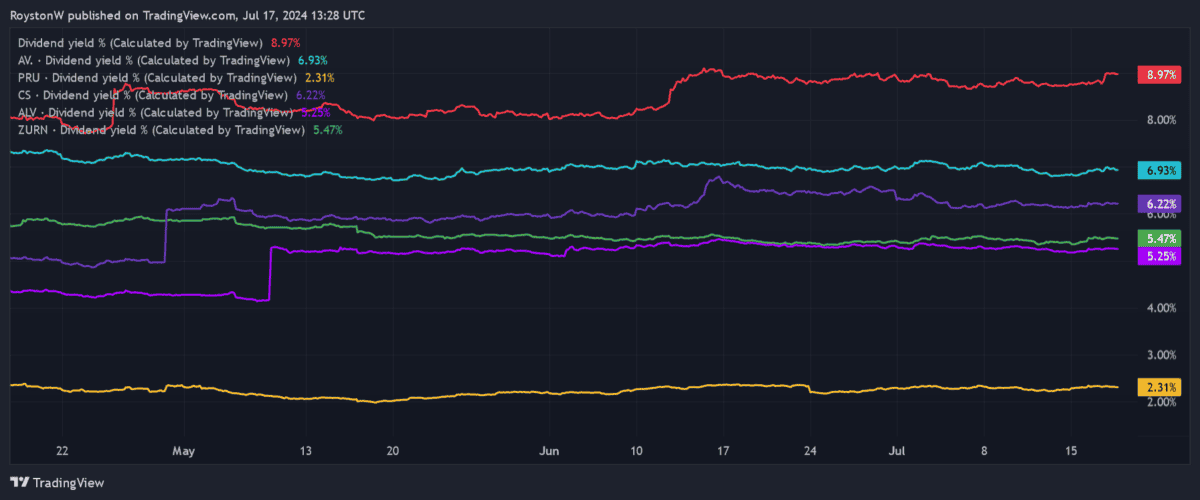

Communications giant WPP (LSE:WPP) also offers exceptional all-round value at 725.8p per share. It trades on a P/E ratio of 8.2 times for this year. Meanwhile, its dividend yield clocks in at a chunky 5.3%.

Advertising spending is one of the first things that companies cut when times are tough. Current difficulties meant that WPP’s own net revenues dropped 1.6% on a like-for-like basis during the first quarter.

However, I believe these current troubles are baked into the FTSE 100’s low valuation. It’s also my belief that revenues here could rebound strongly once the economic cycle improves, helped by its huge exposure to developing markets.

I also think WPP’s massive investment in digital advertising and artificial intelligence will pay off handsomely.

Legal & General

Legal & General Group‘s (LSE:LGEN) share price is tumbling sharply. Investors have given the firm’s plan to grow dividends at a slower rate a big thumbs down. What’s more, concerns that interest rates may remain longer than initially anticipated have pulled its shares lower.

In my view, this represents an attractive buying opportunity. Asset managers like this may struggle in the near term if central banks fail to meaningfully cut rates. But Legal & General has considerable growth potential over the long term as demand for retirement and wealth products steadily takes off.

I also believe the market has massively overreacted to the company’s fresh dividend policy. Its huge dividends are still expected to grow 2% between 2025 and 2027. And the Footsie firm plans to supplement a rising dividend with further substantial share buybacks.

At 226.8p, Legal & General shares trade on a forward price-to-earnings growth (PEG) ratio of 0.1. A reading below one indicates that a stock is undervalued.

What’s more, its gigantic 9% dividend yield beats those of its FTSE 100 rivals by a huge margin. I think it’s another brilliant value stock to consider.